Few individual stocks are truly worthy of a long-term investment. The truth of the matter is that most stocks have solid quarters, but rarely sustain that strength and growth over years and decades. In fact, many industry groups suffer from the same problem and it’s one reason why many long-term “buy and hold” investors don’t understand why their strategy is failing. They simply don’t buy the right stocks, those that have exceptional long-term track records. Companies need long-term competitive edges, innovation, excellent leadership, and lots of luck to perform at a high level over decades and few accomplish it.

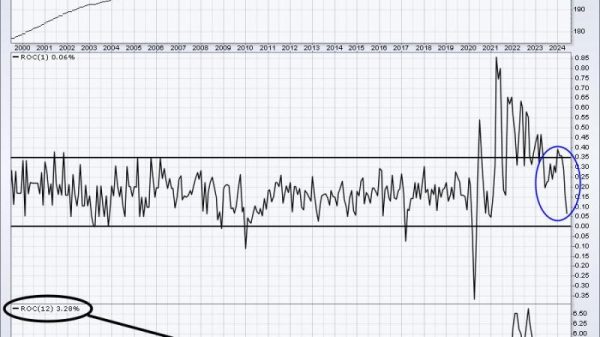

One example of an industry group that fails the test of time is apparel retailers ($DJUSRA). Yes, they’ll catch fire from time to time, but investing long-term in apparel retailers usually results in underperformance. Take one look at this long-term chart, especially the last decade, of the DJUSRA and you’ll see what I mean:

If you only look at the top panel, you’ll see what appears to be a fairly solid long-term uptrend. However, the bottom panel reflects the relative chart, apparel retail vs. the benchmark S&P 500. Throughout the entire secular bull market advance since 2013, the DJUSRA has been steadily declining vs. the S&P 500. In order to invest in this area and outperform the S&P 500, you’d better be a great individual stock picker, because the group has been a major disappointment.

This type of relative performance, or lack thereof, is the primary reason we established our portfolios at EarningsBeats.com. We only hold stocks for one quarter, and then we “re-draft” the stocks we want to own for the next 90 days. Our goal is to find stocks outperforming in the moment. By doing so, we avoid the long-term implications of investing in a group that consistently underperforms the S&P 500 like the apparel retailers.

Individual stocks within that apparel retail group, however, can still be great shorter-term investments and I’ll be featuring one of them in our Monday EB Digest newsletter. Subscription is completely FREE with no credit card required. To join, simply CLICK HERE and enter your name and email address and I’ll send you that strong apparel retailer tomorrow morning!

Happy trading!

Tom