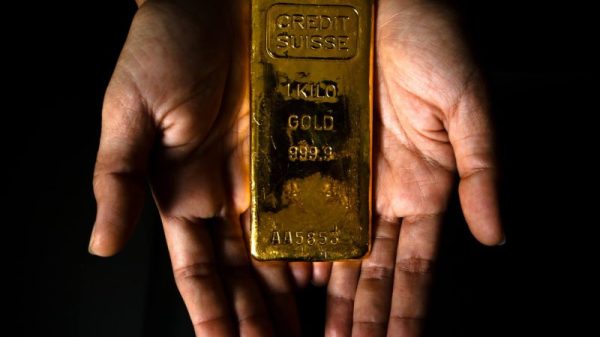

Gold is above US$2,000 per ounce again, and John Feneck of Feneck Consulting believes it’s set to move higher.

Feneck noted that the banking crisis earlier this year added a new floor for the yellow metal; since then, the Israel-Hamas war, which broke out almost two months ago, has created even more safe-haven demand for gold.

‘If it wasn’t for Bitcoin doing so well, (artificial intelligence) doing so well, tech doing so well in general you’d have an all-time high probably already in our view,’ he said. ‘But it’ll just happen next year. We get more time to build positions.’

In terms of gold, he mentioned Cartier Resources (TSXV:ECR) and US Gold (NASDAQ:USAU) as companies he’s interested in, as well as Silver Tiger (TSXV:SLVR,OTCQX:SLVTF) on the silver side. Feneck is also looking outside the precious metals sector — his uranium holdings include Denison Mines (TSX:DML,NYSEAMERICAN:DNN), Uranium Royalty (TSX:URC,NASDAQ:UROY), Forum Energy Metals (TSXV:FMC,OTCQV:FDCFF) and the Global X Uranium ETF (ARCA:URA)

Watch the interview above for more from Feneck on gold, silver and uranium, as well as thoughts on First Tellurium (CSE:FTEL,OTCQV:FSTTF), Golden Metal Resources (LSE:GMET,OTCQB:GMTLF), Talon Metals (TSX:TLO,OTC Pink:TLOFF) and Power Nickel (TSXV:PNPN,OTCQB:PNPNF).

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.