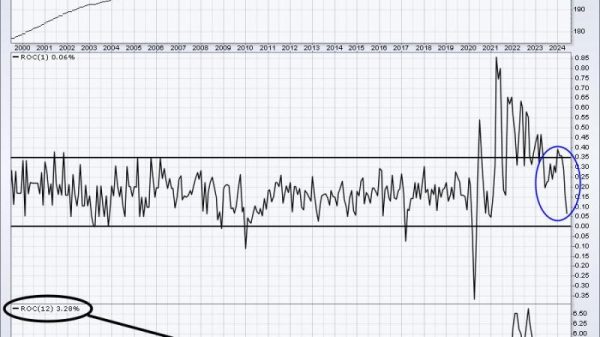

Today Carl and Erin cover the topic of On-Balance Volume (OBV) as a representation of volume trends. This came to their attention as they uncovered an OBV negative divergence on the SPY chart.

Carl completes a review of the weekly charts for the Magnificent 7 stocks, giving us a more intermediate-term picture of their strength and weakness. He also enlightens us on participation within the small-cap index ETF, IJR.

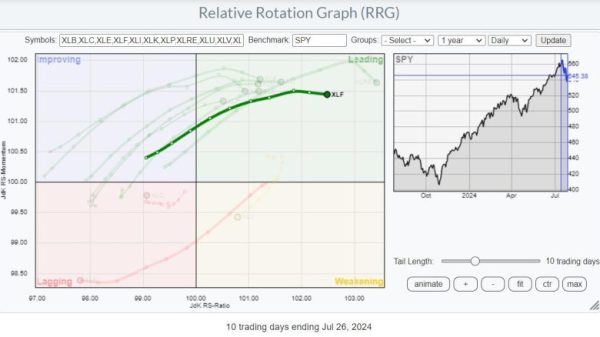

Carl first reviews the market trend and condition with a discussion of key DecisionPoint indicators. He covers Bitcoin, Crude Oil, the Dollar and a special discussion on the Gold chart. Erin then goes over the sectors with a concentration on Regional Banks (KRE).

The rest of the program was devoted to symbol requests.

01:25 Market Overview

10:01 Magnificent 7 weekly chart review

13:16 OBV Discussion

17:40 Small-cap overview

21:00 Questions

25:30 Sector Review and Regional Banks (KRE)

33.37 Symbol Requests

To join us LIVE, go to the homepage for DecisionPoint.com and sign up to attend live!

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)