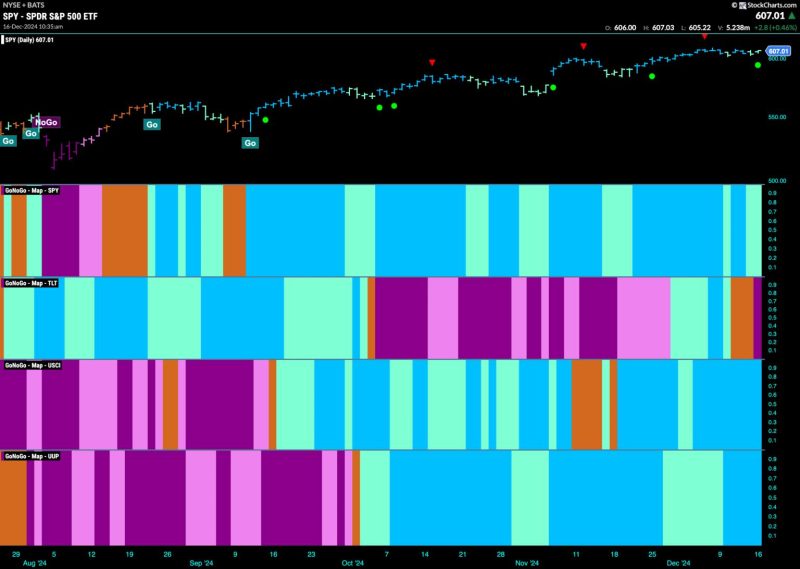

Good morning and welcome to this week’s Flight Path. The “Go” trend in equities continued again this past week but we saw some weakness as GoNoGo trend painted a few weaker aqua bars. Treasury bond prices experienced a change in trend as a few bars of “Go Fish” gave way to a purple “NoGo” bar. U.S. commodities painted a full week of strong blue “Go” bars and the dollar also saw strength return with strong blue bars.

$SPY Shows a Little Weakness with Aqua Bars

The GoNoGo chart below shows that price has moved mostly sideways since the last high and the Go Countertrend Correction Icon (red arrow) that came with it. The waning momentum suggested that price may have a hard time moving higher in the short term. GoNoGo Trend has painted a few weaker aqua bars as well and we see GoNoGo Oscillator testing the zero line from above. It will need to find support here and if it does we will be able to say that momentum is resurgent in the direction of the “Go” trend.

On the longer term chart, the trend continues to be strong. However we are seeing the price range shrink as we edge higher. GoNoGo Oscillator is not in overbought territory and seems to be resting at a value of 3. We will watch to see if the oscillator falls to test the zero line perhaps in the next few weeks.

Treasury Rates Return to Paint “Go” Colors

Treasury bond yields reversed course and after consecutive amber “Go Fish” bars that often come as a transition between trends we see the indicator painting “Go” colors again. GoNoGo Oscillator has broken back into positive territory which confirms the trend change that we see in price above.

The Dollar Sees a Return to Strength

The dollar rallied this week with a string of uninterrupted bright blue “Go” bars. Price is approaching resistance from prior highs and we will watch to see if it can continue higher. GoNoGo Oscillator broke back into positive territory and we saw a Go Trend Continuation Icon (green circle) indicating that momentum is resurgent in the direction of the “Go” trend. We will watch to see if this will give price the push it needs to make a new high in the coming days and weeks.