The S&P 500 closed at an all-time high on Friday as investors returned to buying equities in force following a short-lived market stumble to start the new year.

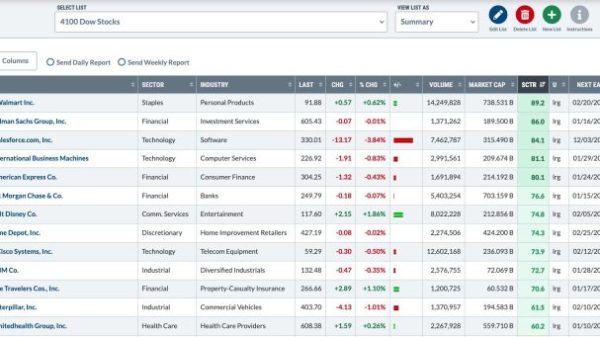

The broad market index rose 1.23% to settle at 4,839.81, surpassing both the prior record intraday and closing highs from January 2022. Meanwhile, the Dow Jones Industrial Average, which set its own record at the end of last year, added 395.19 points, or 1.05%, to end at 37,863.80. The Nasdaq Composite advanced 1.70% to 15,310.97. The smaller, more tech-focused Nasdaq-100 gained 1.95% to also hit a record high.

All three major averages are now in positive territory for 2024, with the 30-stock Dow going green during Friday’s rally.

Following a 19% loss in 2022, the S&P 500 roared back in 2023, posting a 24% gain as the economy skirted a recession that many had expected and inflation came down to levels that allowed the Federal Reserve to pause its interest rate hikes. The benchmark came close to reaching a record following a forceful fourth-quarter rally, but ultimately fell short. The market rally paused a bit to start 2024 as investors took some profits in the Big Tech leaders like Apple.

But they returned to buying those tech leaders in recent days. Friday’s milestone confirms that the stock market is officially in a bull market that began in October 2022, and not just a bounce within a bear market. The S&P 500 is up more than 35% since that low.

“In the mind of the investor, [companies] leading in AI or having a product set that’s differentiated in the tech space are very, very strongly leading the market. That’s been a wave that’s persisted throughout the remainder of last year and into 2024,” said Matt Stucky, chief portfolio manager at Northwestern Mutual Wealth Management.

The tech sector gained 2.35% on Friday and more than 4% during the trading week, making it the S&P 500′s best-performing sector week to date.

Whether the broader market index can maintain its growth momentum in 2024 “is going to be a question of whether the Fed is able to stick a soft landing or not,” said Stucky. He noted that the driver of the S&P 500′s growth in 2023 was tied to multiples, rather than earnings.

“Multiples rise coming out of economic slowdowns, because investors are pricing in a recovery. If that recovery doesn’t materialize, then you do have to question the sustainability of not only holding on to new highs, but making new highs beyond that,” Stucky added.

Fresh consumer data on Friday indicated that consumers are becoming more confident on the economy and inflation. The University of Michigan’s Survey of Consumers showed a 21.4% year-over-year jump to reach its highest level since July 2021.

Insurance company Travelers rose 6.7% after posting an earnings beat. Schlumberger gained 2.2% after beating on top and bottom lines, and Ally Financial surged over 10% after reporting strong quarterly results and a sale of a business unit to Synchrony Financial.